In the latest episode of Navixy Talks we interview our partner, David Henderson, CEO of DRVR. The company is based in Thailand and David generously shares his expertise on telematics in Asia. How to stand out from the competition? How to grow during the pandemic? What to expect in the future and what trends to focus on? Learn in the article or watch the video.

– Hello David. Thank you for joining Navixy Talks. I will go ahead with the first question: how do you describe telematics in Thailand nowadays and what is it personally for you?

– Telematics in Thailand has quite a low penetration rate. If you look across the world, Southeast Asia has one of the lowest penetration rates for telematics worldwide. This is one of the reasons why we decided to set up DRVR in Thailand.

Another reason we chose Thailand was because of the large presence of the automotive industry here. Thailand is a major manufacturing hub in Southeast Asia with around 2-2.5 million cars being produced each year.

The other interesting fact about Thailand is, it actually has one of the worst driving safety records: it’s the second in the world for road deaths. Tens of thousands of people every year die in road accidents in Thailand, so there's definitely the problem here and the solution is, you know, telematics.

Tens of thousands of people die in road accidents in Thailand every year, so there's definitely the problem and the solution is telematics.

– What do you put into this word — telematics? What kind of services or features. And what do you think telematics in Thailand means for an average person or corporations?

– In Thailand and other Southeast Asian markets there've been some compliance drivers to market growth. Now if you want to register a 6-, 8- or 10-wheeler trucks or larger vehicles, you need to get a compliance certificate from the road authority. That has driven growth for basic GPS services.

Also people now become more familiar with GPS and telematics. They're not stopping at GPS: they want things like driving behavior, they want to understand fuel consumption. And there is more knowledge in the market now than there was five years ago, when we first started in Thailand. People now have a better understanding of what telematics is and what the benefits are for their business. We're focusing on business to business. We're not really involved in consumer telematics, but we do have an insurance telematics function as well.

– How has the telematics in Thailand changed? If we speak globally, 5-10 years ago a GPS tracker was something unique and progressive. Now you can see it almost in every car shop or car service. So how was it five or ten years ago and how is it now?

– 10 years ago GPS tracking or fleet management or telematics were pretty small in Thailand. There were not many providers and they were providing essentially a basic tracking service. Then, as I mentioned, the government introduced mandatory GPS tracking for heavy commercial vehicles and for vehicles carrying dangerous goods. That led to big growth in the market but more towards the bottom end of the market. The new companies were coming in largely from China and other markets to sell a device.

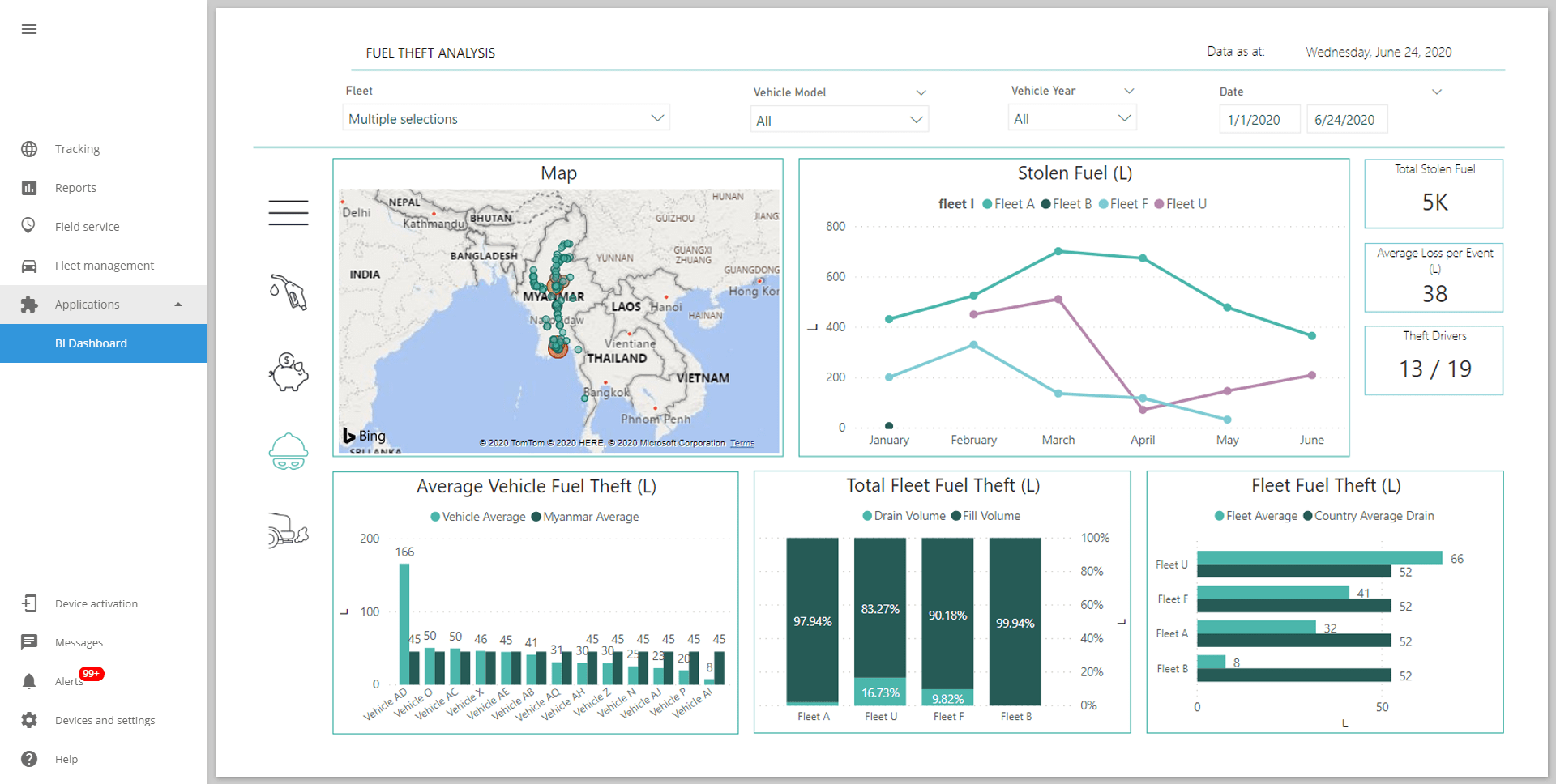

Now, we don't position ourselves at that end of the market: we're more interested in offering services, including fuel theft detection which is a major problem in Southeast Asia, insurance telematics, driving behavior monitoring. Now with the COVID-19 situation companies are much more interested in not just being compliant with regulations but actually saving money on their fleet operations. By using the platform with the fuel theft monitoring and the BI that we've developed, customers can save 20 even 30% on their fuel costs over a month and that's a very significant saving.

Now with the COVID-19 companies are much more interested in not just being compliant but actually saving money on their fleet operations. By using the platform, customers can save 20-30% on their fuel costs over a month and that's a very significant saving.

– This is a really good point, that the overall situation will make businesses reconsider what services they are purchasing and how they can reduce their costs. Okay, so we understood that this is pretty much the regulations in Thailand. How long ago have they been released?

– Around 4.5 years ago there was a very significant truck accident, where a truck driver, who didn't even have a license and was also drunk, drove the truck off a bridge and smashed into a petrol station. Around 300 people died in the fire. So the government started putting in steps to identify who's driving the vehicle, whether they are safe to drive. Now there's a magnetic card reader to swipe your Thai driving license. This is a major strategic project for the Thai government.

It led to the mass adoption of GPS, but now companies are looking for more than just a basic GPS service. People who have that are also looking for add-on features like fuel theft detection.

– Do you operate only in Thailand or you offer services in other markets as well?

– We operate across Southeast Asia, but primarily at the moment we're operating in Myanmar, Indonesia, Philippines and we'll soon be opening in Cambodia as well. We have a number of customers spread across those countries in a number of different industries. That includes car rental, logistics, leasing companies, companies operating mining and a number of companies in the cold chain sector.

– Is the South-Pacific region pretty much the same? Have you noticed any major differences between the markets?

– There are significant differences. It would be similar to the differences in markets in Europe. For example, Luxembourg probably has similarities to Singapore. It's a small country, extremely rich. And then at the other end of the scale, you have some of the Eastern European places which are less well developed and there's more of a history of corruption. This is similar to Southeast Asia: so you have places like Singapore, and at the other end you have places like Burma, Laos and Cambodia that don't really have an established rule of law. Our customers are asking us to help them protect their cargo from the police, for example.

If you look at places like Burma, you know five years ago the internet didn't exist there. You could buy a SIM card but it cost a thousand US dollars. So it's a very new market. Thailand, Malaysia, Singapore are much more established. They've been around longer in terms of tech.

– Let’s speak about your key customers. As you said, you're mostly working on B2B. Are these small and medium companies or big enterprises?

– We have a bit of a mixture. Generally speaking, the lead times for winning big corporates in Southeast Asia are quite long. If you're going to focus just on that sector you need to have very good connections and you also need to have a lot of time. You can't really go after the big corporates and hope that you'll be able to close those deals very quickly. They tend to have thousands of vehicles but the sales timeline for closing deals is quite long, like years.

Whereas the smaller companies tend to make decisions much more quickly and you can close those deals in a matter of days or even hours. So most of our customers are small to medium-sized fleets but we do have some large corporates that we're working with, including Cycle and Carriage and Phatra Leasing, which is the largest leasing company in Thailand.

If you're going to focus just on enterprises you need to have very good connections and you also need to have a lot of time.

– Based on your expertise, how long should you be dealing with big corporates to close the deal? Can you estimate this time range?

– It's really hard to give a concise figure on that. Big corporations usually want to work with people who are their friends or they have connections with, especially in markets like Thailand. As a foreigner, it can be quite hard to win those deals. Generally, if there's a choice between going with a local Thai guy or going with a foreigner, if all things being equal, they would go with the local Thai guy 100% of the time.

The other thing is there's a bit of a risk aversion as well. Southeast Asian markets prefer to go with the product that they already know. I'm not suggesting for a minute that it's a hopeless situation, but these are things that people need to be aware of. It takes time to build the relationships, you need to build networks and if you can demonstrate that your product is better than the guy down the road — for the same price or an equivalent price — then you can win business and we've managed to do that.

– Sounds pretty clear. Do you have any local person in your team, who has great contacts?

– We do now. We didn't initially understand the importance of networking and connections, how crucial that is. So yeah, it's something that we are focusing more on. Our product is an excellent product, but it's not all and some of those corporate circumstances don't always win by having the best product. You do also need to have the relationships, the service networks and the people on the ground to support you.

Our product is an excellent product, but you also need to have the relationships, the service, networks.

– So our advice is to have good contacts and maybe visit some networking events to get them more, yes? (David nods) You also mentioned a great product itself. What do you think makes your company different and special to win customers? How do you stand out of the competition?

– We focus on two areas. One of those is to offer extremely high-quality service to customers. We manage the devices, we control every step of that process. The second area is that we focus on offering value-added services on top of our core platform. The customers can use the standard platform, but we can also offer them, for example, power BI add-ons for more detailed and richer analytics.

We’ve also built a car-sharing platform right on top of the core platform, so the customer can add that on, maintaining the same interface but just having some additional screens for managing their cars, bookings and payments. So I think for us it's a combination of quality service plus maybe 20-30% customization and being able to deliver those new features.

– You mentioned some of your own unique solutions that you're offering. Can you demonstrate what it looks like, so our followers who watch this video will have an idea?

– Sure. We have two bespoke services that we've developed on top of the core Navixy platform. One of those is a car-sharing application and the other one is our Power BI dashboard. We pull data from the API, we process and analyze that data and then we present that back to the customer. That's embedded within the service itself, so you just have an additional button at the bottom.

Learn more about the add-on from Navixy Marketplace or watch the video interview. For easy navigation use the time codes.

– This seems really interesting and customized for each individual case. I will just make a small note: all these tools can be seen in Navixy web user interface itself because it's integrated into our application section.

– Yes, there's no separate login. They don't need to have a Power Bi account either. Log in using Navixy credentials, access the portal, and then just click an option at the bottom to access the dashboard. And then if it's embedded within their service, they get access to it.

– Let's go back to our questions. We see that by using Navixy API you're proposing customized applications and solutions to the customers and this is really helping you a lot to stand out of the crowd. If you speak about the main challenges for telematics in your region, how can you describe them? How does your company tackle them down?

– One of the main challenges is cost. There's been a perception that telematics is quite expensive and that the returns on investment take a little bit of time to materialize. In some industries, for example insurance, the margins are quite low. Markets like Thailand are trying to offer mass-market, UBI telematics solutions based on devices that cost a hundred dollars. When your insurance policies are two hundred dollars it isn't realistic in this market. You have to remember that the GDP of these countries, except for maybe Singapore, is a lot lower than in most European countries.

Besides, there are dozens of different languages that are spoken, so if you want to deploy your service in countries like Burma or Thailand, Laos, Cambodia, you're not going to be able to deploy 100% in English. You will need some localization.

– Do you offer a Thai version?

– Absolutely. Without a Thai version, we wouldn't be able to sell into the Thai market. English is spoken by only about 5-6% of the population. If you're offering your service to a logistics company or fleet management company in the provinces, then you will 100% need the service to be delivered in the Thai language, as well as customer service support, etc.

– Let’s speak more about challenges in terms of the COVID-19. Did the telematics in Thailand suffer much and what do you think can change?

– It's definitely had an impact on telematics but I think mostly in a positive way. Traditionally companies in Thailand were very heavily focused on doing jobs in a traditional old-fashioned way. I've been to many logistics and operation centers across Thailand: you'd have dozens of staff sitting there in a control room, piles of papers everywhere.

So because there are fewer people in those operation centers these days, they need to digitize and this has been a bit of a spur for growth for us. We've had a lot of inquiries as a result of COVID-19 and I think business is growing for us. So there's definitely been a lot of interest in the benefits that telematics can offer: tracking people especially for working remotely, making sure that staff is safe. It's definitely becoming an important consideration.

So because there's fewer people in those operation centers these days, they need to digitize. We've had a lot of inquiries as a result of COVID-19 and I think business is growing for us.

– Speaking about these changes, what do you think the future of telematics will be?

– I think the future's very positive. But it really depends on what kind of services you're offering in the market. If you're just offering a run-of-the-mill GPS tracking solution then I don't think that's going to be a very positive future for your company, because that's become a commodity business. You need to really offer something that's different, value-adds, and that also creates the potential for additional revenue for customers: reduces costs, generates more revenue and stands out a little bit from the crowd.

One of the things that the Thai government is doing and many others are doing in the region is introducing more stringent requirements for compliance. It's no longer good enough to have a GPS device that sends data every 90 seconds. You need to send data every five seconds, send telematics data like braking, accelerating and so on. And there are more stringent requirements coming in. And this is important because road safety is a disaster in Thailand and without this kind of measures, it's very difficult to reduce road deaths.

If you're just offering a run-of-the-mill GPS tracking solution then I don't think that's going to be a very positive future for your company. You need to offer something different, that creates the potential for additional revenue for customers.

And we've seen a lot more interest in video telematics. People want to understand and remotely know what's going on with your vehicles. There's definitely a huge potential not just in Thailand but in Southeast Asia in general.

– When you analyze customer requirements, what do you see as the actual future trends? Probably some customers are asking for unique or unusual features that will be forgotten in a couple years. But what do you really think will be a trend? You mentioned video streaming, can you add anything else?

– We've had some good success in understanding that the customers are not just interested in having someone sitting there, staring at the screen, watching vehicles. They're interested in the whole process: they want to manage tasks, they want their customers and their staff to know what's going on across the whole process. For example, you've sent a driver out, where are those goods? When can the customer see what's going on? When do they expect those goods to arrive?

Customers are not interested in staring at the screen watching vehicles. They're interested in the whole process: they want to manage tasks, they want their customers and their staff to know what's going on across the whole process.

Now we're living in a hyper-connected world where having access to the data in real-time is critical. But you don't want just to be bombarded with a lot of data. What's needed is to connect the dots: so you have the data coming in but what's the end output? The idea would be: when an event comes in, it triggers a process that then triggers invoicing to happen, forms to be sent, notifications to happen. So this is where I believe the industry is heading. More integration with services like SAP, ERP systems and customer back-end systems, warehouse management, etc.

– What advice would you give to other telemetric service providers, existing and emerging?

– We've had a great experience working with Natalya and the team at Navixy. I would say building something which is already out there and robust is not the way to build a successful business. Build things on top of the core platform, additional services and offerings. Utilize some of the great services you can see in the Marketplace to enhance that service. This is called a platform play. In Navixy we’ve got a great offering, really love the protocol parts, all of the huge numbers of devices that are connected. It's been really good working with the team and we're looking forward to continuing that strong relationship over the next few years.

We thank David for the honest and open discussion. If the interview inspired you to use Navixy API more actively and you need some assistance there, please don’t hesitate to contact our Customer Success and Support teams. For those of you who’d like to become our guest on Navixy Talks, please inform your Navixy manager. We’ll gladly consider you for the upcoming episodes.

Great job on staying connected during the lockdown and pandemic! Keep it up — subscribe to our social media, blog updates and youtube.