Vehicle Leasing Reinvented: Why Telematics Is the New Competitive Edge

How smart companies are changing the game while competitors argue over interest rates

Marcus Thompson, managing director of a mid-sized leasing company in Birmingham, couldn't understand why his best clients were leaving one by one for London-based competitors. His rates were competitive, service was solid, reputation impeccable. The answer came unexpectedly during a pitch meeting when a potential client casually asked: "Do you offer online fleet monitoring? We need to see where our vehicles are, how much fuel they're using, how our drivers are performing..."

That moment was transformational. Thompson realized the market had fundamentally shifted. Clients weren't just buying vehicle rental anymore — they wanted comprehensive solutions for managing their operations. And those who understood this first were already rewriting the rules of the entire industry.

Today, leasing companies face a choice: remain asset providers secretly monitoring their own equipment, or become technology partners who share data and help clients optimize their businesses. Experience shows the most forward-thinking choose the latter.

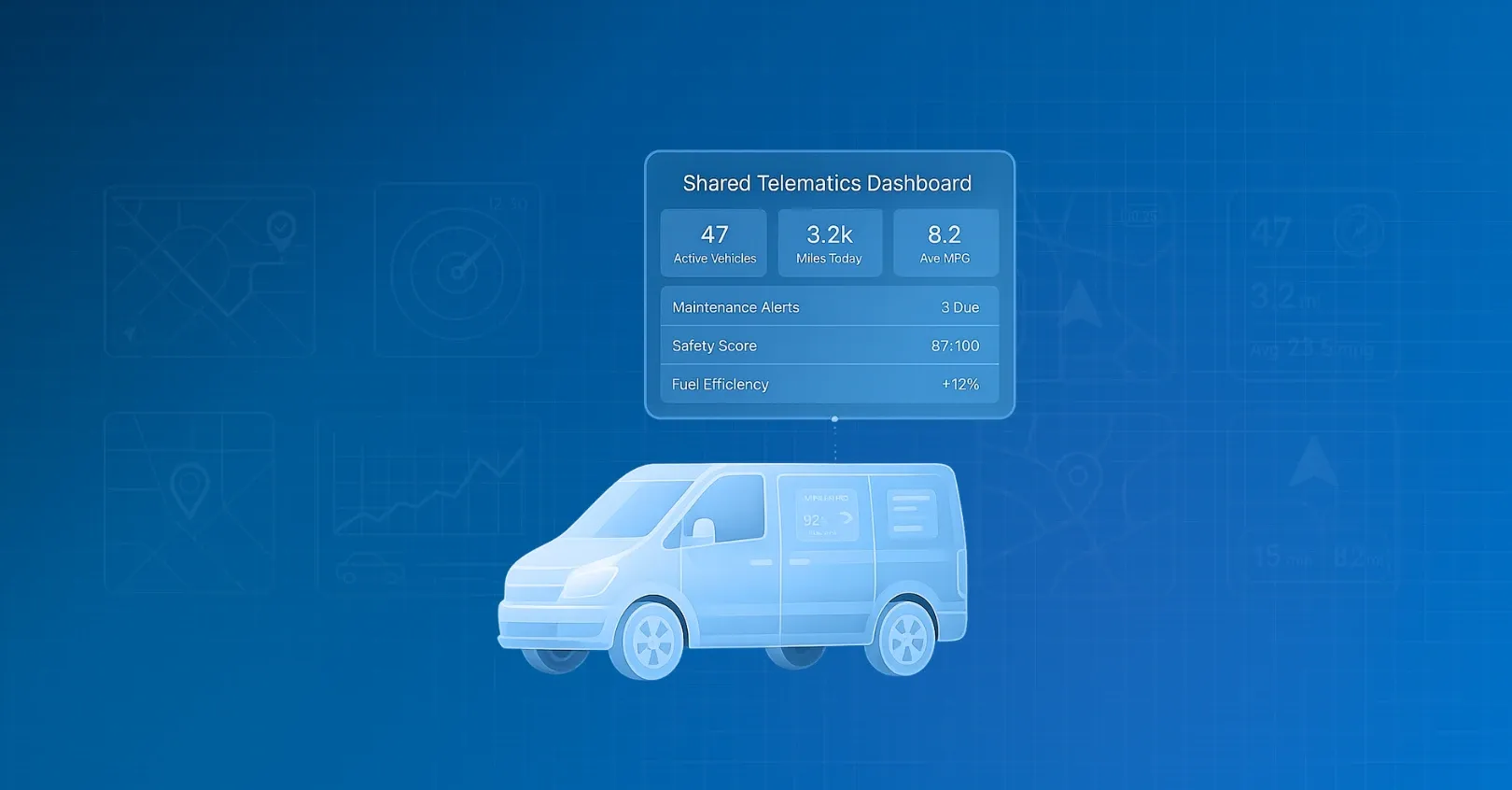

The secret lies in transforming internal telematics monitoring into a client service. Basic GPS and tracking functions can be provided free as elements of trust and engagement, while advanced analytics, optimization consulting, and system integration become premium services that multiply relationship value.

Chapter 1. Anatomy of Transformation: How Technology Changes the Economics of Relationships

Visibility as the New Currency of Trust

Back to Marcus Thompson's story. After that conversation, he spent three months studying how to turn internal monitoring into a client service, settling on the Navixy platform. The decision was bold: provide clients free access to basic GPS monitoring functions — the very data the company was already collecting to track its own assets.

He connected his first clients to the portal at no charge — simply to gauge their reaction and understand which capabilities truly mattered for business.

The results exceeded all expectations. Clients started calling not with complaints, but with questions: "Can we set up detailed reports for each driver?" "Do you have route optimization analytics?" "Can you integrate this data with our accounting system?"

These questions became the foundation for developing premium service offerings. Basic GPS monitoring remained free, but advanced analytics, personalized reports, optimization consultations, and integration solutions became high-margin services.

Through six months, the picture changed dramatically. Average contract duration grew from 18 to 28 months. Early terminations dropped by two-thirds. Most importantly, clients began recommending Thompson's company to their partners — not as "cheap leasing" but as a "technology solution."

What's the secret behind such transformation? Thompson understood a key insight: leasing companies already spend money installing GPS trackers and collecting telematics data for their own needs. But this same data represents enormous value to clients—and most are willing to pay extra for access to information about their own fleets.

By providing basic GPS data access for free, Thompson solved two problems simultaneously: he strengthened client trust (now they saw the same information as the lessor) and created a foundation for selling premium analytical services.

This "freemium" model works flawlessly in leasing. Clients get used to basic functionality, understand the value of data for their business, then become willing to pay for expanded capabilities: detailed analytics, personalized reports, integration with their own systems, optimization consulting.

Prevention Economics vs. Reaction Economics

Traditional leasing models are built on reaction: something breaks — we fix it, vehicle gets stolen — we search for it, client complains — we solve the problem. Telematics flips this logic completely.

Consider a specific example. "Peak Logistics" leased 25 trucks from Thompson for long-haul transport. In the first month, the telematics system detected atypical engine behavior in one vehicle: unusual vibration at certain RPMs.

Under the old system, this information either wouldn't reach the lessor at all, or would arrive as an emergency roadside call. Under the new conditions, the truck was sent for planned diagnostics, replacing a worn part for £1,200 instead of a major overhaul costing £24,000.

The savings are obvious for the lessor. But the client's benefit is even greater: the truck didn't break down mid-route, cargo was delivered on time, reputation with customers remained intact. The total damage avoided — approximately £80,000.

Scaling this approach across the entire fleet, Thompson achieved statistics that created a sensation among his insurance partners: serious breakdowns dropped 60%, vehicle downtime decreased 40%, insurance claims fell 35%. The result — insurance rate reductions for his clients of 20-25%.

Chapter 2. New Geography of Profit: Where to Find Money in the Data Age

From Rental to Consulting: A Transformation Story

A year after implementing the shared telematics data model, Thompson's business changed fundamentally. Where previously 95% of revenue came from lease payments, the structure became much more diverse.

Consulting services based on telematics data brought 18% additional revenue. Clients, having gained access to basic information about their fleets, quickly understood its value and began requesting deeper analytics: route optimization, driver efficiency analysis, predictive maintenance forecasting.

Training programs based on real data generated another 12% growth. With access to detailed information about each driver's style, the company could create personalized programs for economical and safe driving.

Integration services became an unexpected hit — 15% additional margin. Clients accustomed to telematics data wanted to integrate it with their accounting systems, CRM, route planning software.

But the main discovery was in pricing strategy. The most profitable clients were those who started with free basic monitoring, appreciated the data's potential for their business, then subscribed to the full premium services package. They're willing to pay 40% more for "smart leasing" — not for vehicle rental itself, but for comprehensive fleet management solutions where telematics data becomes the foundation for optimizing all processes.

The Mathematics of Loyalty: Why Clients Don't Leave

Thompson's economist calculated an interesting pattern. The average cost of acquiring a new leasing client is about £12,000 per contract. Meanwhile, profit per client over a standard two-year period runs approximately £65,000.

With telematics integration, the economics changed radically:

- Average relationship duration grew from 24 to 38 months

- The share of clients renewing contracts increased from 35% to 75%

- Additional vehicles leased by existing clients grew 2.3x

The reason for such loyalty — high switching costs. When clients get used to planning routes through your portal, analyzing expenses through your reports, training drivers via your programs, changing suppliers means months of rebuilding familiar processes.

Moreover, clients accumulate historical databases about their fleet operations. This information is invaluable for planning and optimization. Switching to another lessor means losing this data, creating an additional barrier to departure.

Premium Positioning in a Commoditized Market

The most important change occurred in how clients perceived the company's services. Where Thompson previously competed purely on price ("our rate is half a percent lower"), conversations now revolved around value ("we'll help you save 15% on fuel and 25% on repairs").

Concrete example: "Thames Transport" was choosing between Thompson's offer (£8,200 monthly per truck plus telematics package) and a competitor (£7,000 for the same truck with no additional services).

The calculation was straightforward. Route optimization savings totaled £2,200 monthly per vehicle, fuel consumption control saved another £1,500, predictive maintenance saved £950. Total savings: £4,650 against £1,200 premium. The choice was obvious.

This example illustrates the key principle of new leasing economics: clients are willing to pay more for rental if they receive tools for radically reducing operational costs in return.

Chapter 3. Technology as Competitive Weapon

Security: From Insurance Claim to Managed Risk

UK vehicle theft statistics are alarming: a vehicle is stolen every 5 minutes, with total losses exceeding £500 million annually. For leasing companies, this problem is critical — a stolen vehicle means complete asset loss while obligations to banks remain.

Navixy fundamentally changes the statistics. Vehicles with GPS monitoring are recovered in 95% of cases versus 50% for untracked vehicles. But more importantly — the ability to prevent theft rather than search for already stolen equipment.

A client story from Thompson's "BuildCorp" is illustrative. One night, the system detected an attempt to start an excavator unauthorized at a construction site. Engine blocking activated automatically, the siren sounded, alerts went to the equipment owner, security company, and police patrol.

The criminals were caught on site. Damage — zero. The £360,000 excavator remained intact. But most importantly, this incident became the basis for renegotiating the insurance contract. Fully comp premiums dropped 35%, saving £14,400 annually on one equipment unit.

Scaling this experience, Thompson concluded a partnership agreement with the region's largest insurance company. Now all his clients automatically receive preferential rates, while he earns commission from the insurer. Additional profit — about 8% of primary turnover.

Analytics That Pays in Pounds

Telematics data isn't just numbers on a screen. It's ready business solutions, each quantifiable in pounds.

Driver efficiency analysis example. The Navixy system showed that three of "Midlands Distribution's" 15 drivers worked significantly less efficiently than others: taking more time on routes, frequently violating speed limits, consuming 20% more fuel.

Instead of terminating these employees, they decided on additional training. Within a month, their metrics matched team averages. Savings totaled £3,600 monthly — with training costs of £4,800 for the entire program.

Route analysis yielded even more impressive results. The system proposed logistics chain optimization that reduced total fleet mileage by 18%. Fuel and depreciation savings — £9,600 monthly.

Key insight: every element of telematics analytics can and should be translated into economic indicators. Clients are willing to pay for technology only when they clearly see its impact on profit.

Compliance as Revenue Source

UK legislation for commercial transport is becoming increasingly strict. Tachograph requirements, driver working time controls, environmental standards, digital reporting — the list keeps growing.

For most companies, this is a headache and additional expenses. Thompson turned compliance into competitive advantage.

Automated reporting through Navixy saved his clients hundreds of administrative hours. Previously, preparing monthly reports for regulatory authorities took an average client about 32 hours. Now — maximum 2 hours checking automatically generated reports.

This service costs £1,200 monthly per client. With costs under £240 (mainly programmer time for setup), the margin is 80%.

But the main value is in preventing fines. Over the year, none of Thompson's clients received serious sanctions from DVSA or traffic police. Average savings on prevented fines — about £6,800 annually per company.

Chapter 4. The Human Factor: How Technology Changes Relationships

From Control to Collaboration

One of the most unexpected effects of telematics implementation was changing the psychology of lessor-client relationships. Previously, these relationships were built on mistrust: lessors suspected clients might hide actual equipment condition, clients feared unfounded claims.

Data transparency eliminated the basis for mutual suspicion. Both sides see the same picture: mileage, fuel consumption, technical condition, driving style. Disputes disappear — foundations for constructive dialogue appear.

The relationship story between Thompson and "Industrial Solutions" is illustrative. In early cooperation months, the client was wary of telematics monitoring: "Why do you need to know where our vehicles go?"

The turning point came when the system helped find a stolen lorry. The vehicle disappeared overnight from the depot, police were stumped. The GPS tracker showed location — an abandoned industrial area 25 miles from the city. The vehicle was found 4 hours after theft, cargo intact.

Since then, the client's attitude changed completely. Now they initiate meetings to analyze telematics data, request expanded monitoring functionality, recommend Thompson's services to partners.

Proactive Partnership Instead of Reactive Service

Traditional leasing models are reactive: client calls with a problem, lessor solves it. Telematics enables a proactive approach: seeing problems before they become critical.

Specific example. The monitoring system detected that one client's truck began consuming more fuel — from 25 to 30 mpg over two weeks. Simultaneously, average speed decreased and route time increased.

Thompson didn't wait for client complaints. He called himself: "You have problems with your truck, registration such-and-such. Looks like fuel system or turbo issues. Let's arrange diagnostics."

Diagnostics confirmed — clogged injectors. Repair cost £2,000. If the problem hadn't been caught in time, they'd have had to replace the entire fuel system for £14,400.

This approach transforms relationships. The client begins perceiving the lessor not as a supplier who solves arising problems, but as a partner who cares about preventing these problems.

Education as a Service

Unexpectedly, Thompson discovered his clients were willing to pay for training. Not abstract courses, but specific programs based on real data about their fleets.

The "Economical Driving" program builds on analyzing each driver's telematics data. The system shows specific mistakes: where drivers brake too harshly, where they exceed optimal RPMs, where they inefficiently use coasting.

Results are impressive: fuel consumption drops 15-18% on average just one month after training. For a client with 20 trucks, this saves about £12,000 monthly with program costs of £6,400.

The "Safe Driving" program focuses on accident prevention. Based on driving style data, the system identifies high-risk drivers and offers personalized recommendations.

The effect — a 40% reduction in minor accidents, leading to savings on excess payments and preventing increases in insurance premiums.

Chapter 5. The Future Has Arrived: Where the Industry is Heading

Data as the New Oil of Leasing Business

Over three years working with the shared telematics data model, Thompson accumulated a unique information database: over 500 equipment units, 650 drivers, 7.5 million analyzed route miles, 2 million hours of telematics information.

But most importantly — this data became the foundation for creating new services. Clients who gained access to information about their fleets quickly understood its value and began requesting more complex analytical products. Manufacturers became interested in anonymized statistics about actual equipment operation. Insurance companies wanted data on driving style's impact on accident rates.

Just last year, analytical services sales brought the company £220,000 in additional revenue. Considering that the main investments in data collection and processing had already paid off through operational activities.

But the main data value is in prediction capability. Accumulated statistics allow highly accurate forecasting of equipment residual value, breakdown probability, optimal replacement timing.

This provides enormous pricing advantages. Thompson can offer more favorable leasing terms because he assesses risks more accurately than competitors.

Integration as the Key to Scaling

The next development stage is integrating telematics data with clients' corporate systems. Navixy provides APIs that allow embedding fleet information into any accounting system.

The result of such integration — complete process automation. Mileage data automatically enters fuel accounting systems, technical condition information goes to repair schedules, violation reports feed driver motivation systems.

Clients who implemented such integration reduce administrative costs 25-30% and are willing to pay up to 15% more than basic leasing costs for such automation capability.

Ecosystem Approach: From Leasing to Platform

Thompson no longer considers himself a leasing company in the traditional sense. His business is a data platform for managing commercial transport, where basic telematics access creates the foundation for multiple premium services.

The ecosystem includes:

- Vehicle leasing and rental

- Basic GPS monitoring (free)

- Extended telematics analytics (premium)

- Data-based fleet optimization consulting

- Integration with clients' corporate systems

- Personalized driver training programs

- Insurance accounting for telematics data

- Predictive diagnostics-based maintenance partnerships

Clients receive turnkey solutions and are willing to pay substantial premiums for this. Average client spend has grown 2.4x compared to "pure" leasing periods.

But most importantly — such clients practically never leave for competitors. The cost of replacing the entire ecosystem is too high.

Act Now: Define Your Leasing Future

Marcus Thompson's story isn't unique. Across the UK, dozens of leasing companies are undergoing similar transformations. Those who started earlier have already captured leading positions in their regions. Those who delayed are forced to catch up or retreat to the cheap supplier niche.

The leasing market has split in two. First — high-tech companies offering comprehensive solutions and working with premium clients. Second — traditional lessors competing purely on price in the small company segment.

The gap between these segments increases monthly. Profitability in the first segment grows, in the second — falls. First segment clients are loyal and creditworthy, second segment clients constantly seek cheaper offers.

Navixy provides all tools for transitioning to the first segment: from basic GPS monitoring to complex analytical systems and integration with clients' corporate platforms.

The platform has already proven effective through hundreds of implementations in the UK and abroad. Companies that integrated Navixy into their business models show 35-50% revenue growth and 15-25% margin increases in the first two years.

The question is no longer whether to implement telematics. The question is whether you'll start transformation before competitors capture your best clients.

The market is changing right now. The next two-three years will determine who becomes leaders of the new industry and who remains in the rear guard, competing for scraps in price wars.

You have every chance to be first. The key is starting today.

- Chapter 1. Anatomy of Transformation: How Technology Changes the Economics of Relationships

- Chapter 2. New Geography of Profit: Where to Find Money in the Data Age

- Chapter 3. Technology as Competitive Weapon

- Chapter 4. The Human Factor: How Technology Changes Relationships

- Chapter 5. The Future Has Arrived: Where the Industry is Heading

- Act Now: Define Your Leasing Future